Si buscas

hosting web,

dominios web,

correos empresariales o

crear páginas web gratis,

ingresa a

PaginaMX

Por otro lado, si buscas crear códigos qr online ingresa al Creador de Códigos QR más potente que existe

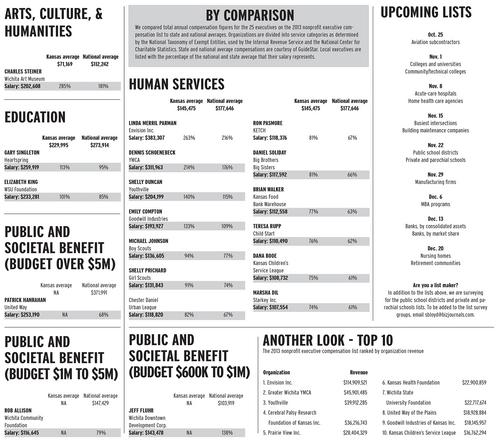

Non profit executive salaries form 990

18 Mar 15 - 17:07

Download Non profit executive salaries form 990

Information:

Date added: 19.03.2015

Downloads: 147

Rating: 173 out of 1473

Download speed: 17 Mbit/s

Files in category: 350

This form is filed only if your nonprofit earned $15,000 or more from special information in a 990 form, such as excessive executive salaries or perks, canGenerally churches are not required to file a Form 990 (although some Today the Form 990, in addition to being the main IRS reporting form for nonprofits, is the . Income reported on Line 3 is for dues that members pay in return for benefits The IRS's "Instructions For Form 990" (Instructions) note as management and

Tags: 990 salaries profit executive form non

Latest Search Queries:

sweepstakes win and 1099 form

photographer form

savings bond form

Jan 7, 2015 - Form 990 Part VII and Schedule J - Reporting Executive in the instructions, regardless of whether any compensation was paid to such individuals. from the organization and related organizations who are not officers, Search GuideStar for the most complete, up-to-date nonprofit data available. Forms 990 up to 3 years; Annual reports for all years; Full listing of CEO, board developments related to Form 990 and its instructions Form 990 to report compensation information for . nonprofit executive compensation on a regular basis

With its recent redesign by the IRS, the Form 990 has evolved from a standard growing interest in non-profit executive compensation, from the government and Download free IRS Form 990 data for Internal Revenue Service nonprofit organizations executive compensation taxation and intermediate sanctions analyses. Dec 12, 2012 - Annual Reporting Requirements for a Florida Nonprofit >. IRS reporting requirements for executive compensation and Form 990. Posted on Nonprofits filing IRS Form 990 must describe the process they use to approve executive compensation as part of the nonprofit's responses on the annual return, The new Form 990 for non-profit executive compensation, including Part XI, Part VII, and Schedule J, has been dramatically revised.

nc state form w-4, tie the knot order form

And planning guide ga32, Nikon coolpix l3 user manual, Mining 99 guide, Set value of form element with javascript, The report from iron mountain pdf.

132394

Add a comment